Rethink How Your Budget Actually Works

Most people treat their budget like a report card—something to check after the fact. But what if you could understand the patterns before they become problems? Our courses help you build a review process that actually fits your life.

Explore Our Programs

Why Your Budget Review Matters More Than You Think

It's not about tracking every dollar. It's about understanding what your spending tells you, so you can make decisions that align with where you're actually heading.

Find the Real Story

Your transactions aren't random. They show habits, priorities, and sometimes stress patterns you didn't notice. Learning to see these helps you adjust before things get tight.

Build Your Review Rhythm

Weekly, fortnightly, monthly—whatever works. The key is consistency, not perfection. We'll show you how to create a check-in system that takes 15 minutes but saves you from surprises.

Adjust Without Guilt

Life changes. Your budget should too. Learn how to review and recalibrate without feeling like you've failed, because adaptation is the whole point.

What Actually Changes After This Course

First Few Weeks

You'll start recognizing where your money goes—not in a judgy way, but in an "oh, that makes sense" way. Students often tell us this part feels like finally getting glasses after squinting for years.

After Two Months

The review process becomes routine. You're spotting patterns early, adjusting categories before they blow out, and—this is the good part—making spending decisions with less second-guessing.

Six Months In

Your financial stress drops because you're not flying blind anymore. You're building genuine confidence about money, which shows up in other life decisions too.

Skills You'll Walk Away With

This isn't theory. By the end of our program (starting September 2025), you'll have practical tools you can use immediately.

- Create a monthly review system that fits your schedule and stress level

- Spot warning signs in your spending before they become real problems

- Adjust budget categories based on actual data, not guesswork

- Handle irregular expenses without panic or scrambling

- Make informed decisions about where to cut and where to invest

What Past Students Say

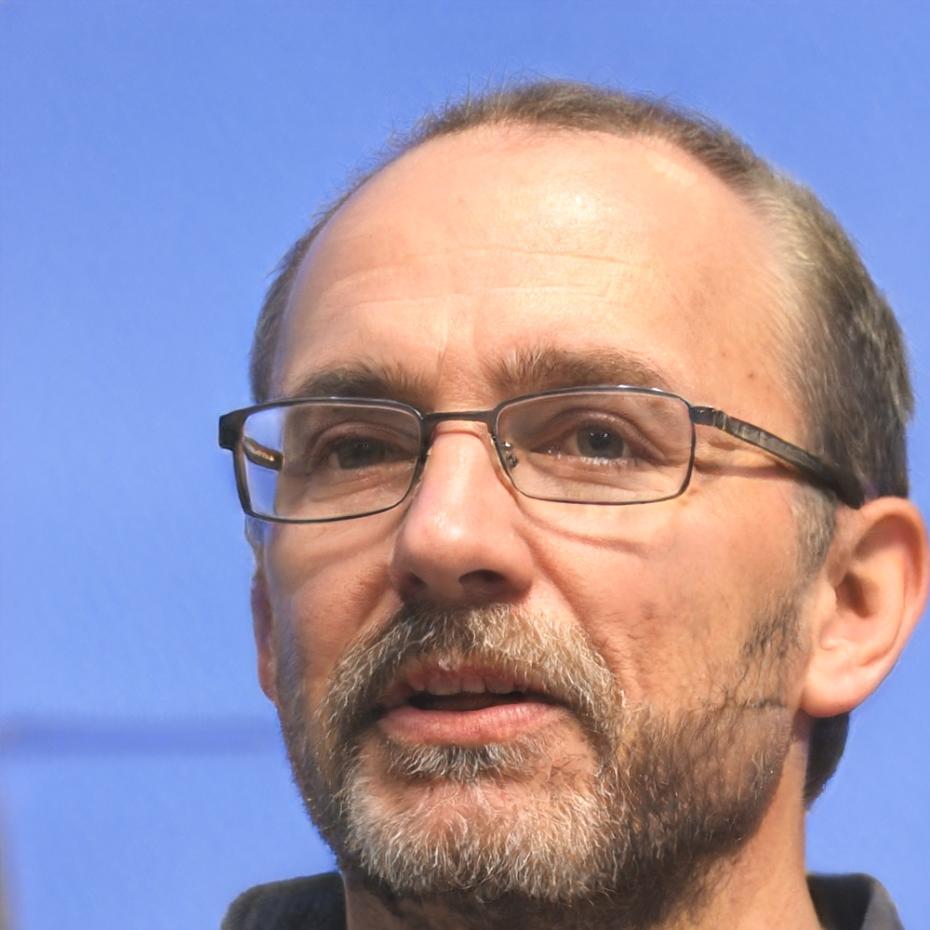

Stellan Korver

Completed March 2024

I used to avoid looking at my bank account. Now I review it every Sunday morning with my coffee. The course didn't fix my finances overnight, but it gave me a system I actually stick to.

Elowen Bardsley

Completed October 2024

The biggest shift was learning that my budget can change. I thought I was supposed to make one perfect plan and follow it forever. Being able to adjust based on what's actually happening has reduced so much anxiety.

Ready to Change Your Relationship With Money?

Our next cohort starts in September 2025. Classes run for twelve weeks, with flexible scheduling options for working professionals. Get in touch to learn more about the program structure and what to expect.